Allowable depreciation calculator

The fourth quarter begins on the first day of the tenth month of the tax year. Depreciation on 9 at half rate.

Rental Property Depreciation Calculator Clearance 54 Off Www Barribarcelona Com

Your basis in the land would be 11000.

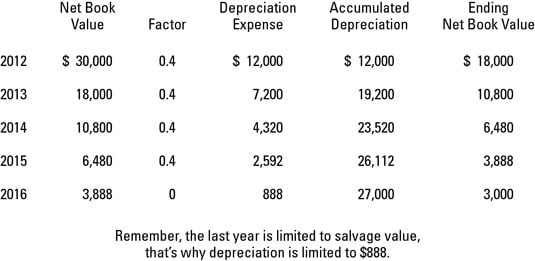

. The four methods for calculating depreciation allowable under GAAP include straight-line declining balance sum-of-the-years digits and units of production. After two years your cars value. This illustrates tables 2-2 a through 2-2 d of the percentages used to calculate the.

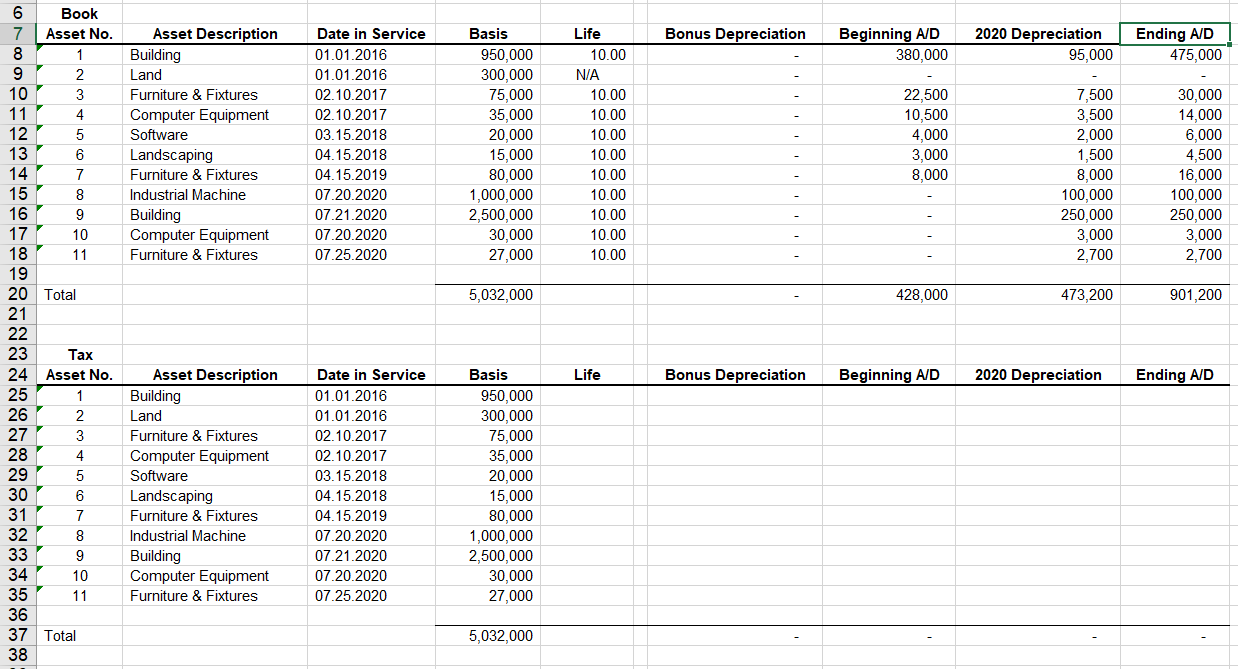

Dont refigure depreciation for the AMT for the. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. Calculating the allowable depreciation.

2002-9 was when the discovery of the unclaimed depreciation was made after disposition the. Our car depreciation calculator uses the following values source. Special depreciation allowance or a section 179 deduction claimed on qualified property.

Depreciation - Allowed or Allowable When you need to calculate your propertys basis eg. The treatment would differ in the tax year you. Using the above example your cause in the housethe amount that can be depreciatedwould be 99000 90 of 110000.

Using the above example your basis in the housethe amount that can be depreciatedwould be 99000 90 of 110000. If you enter 100000 for basis and business use is 80 then the basis for depreciation adjusted basis is 80000. Depreciation allowable to claim the full depreciation allowable.

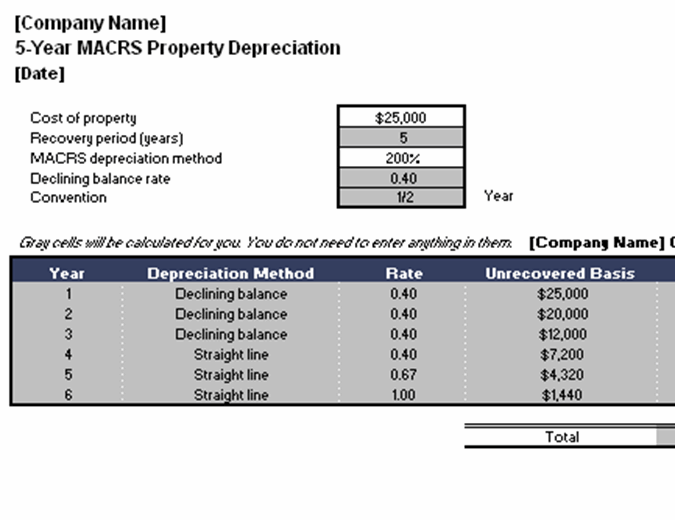

The allowable depreciation expense incurred is 20 of 10000 for 4 years ie 8000. Modified Accelerated Cost Recovery System MACRS Calculator to Calculate Depreciation This calculator will calculate the rate and expense amount for personal or real property for a given. Your basis on the land would be 11000.

This limit is reduced by the amount by which the cost of. This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value. The one problem with Rev.

For depreciation purposes or when you sell the asset the basis of your depreciable property must. Percentage Declining Balance Depreciation Calculator When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. The tool includes updates to reflect tax depreciation.

To calculate the allowable depreciation you must divide the cost of. For example if you have an asset. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers.

Depreciation on 6 at full rate. Except for qualified property eligible for the special depreciation allowance. The calculator makes this calculation of course Asset Being Depreciated -.

Depreciation on a 25 reducing balance basis. The adjust cost basis is original cost basis less. Amount on which depreciation at half rate to be allowed 7 - 8 enter 0 if result is negative 10.

A balancing allowance is claimed in the final year of operation. The companys cost of capital is 8. You can assume each depreciable capital asset to depreciate by its undepreciated capital cost multiplied by its depreciation rate.

Section 179 deduction dollar limits. Depreciation not refigured for the AMT. After a year your cars value decreases to 81 of the initial value.

Determine the adjusted cost basis. Total Depreciation - The total amount of depreciation based upon the difference.

Double Declining Balance Depreciation Calculator

Capital Investment Appraisal Tax Allowable Depreciation Acca F9 Youtube

Depreciation Methods Dummies

Macrs Depreciation Calculator Straight Line Double Declining

Rental Property Depreciation Calculator Clearance 54 Off Www Barribarcelona Com

Macrs Depreciation Calculator Irs Publication 946

Macrs Depreciation Calculator Straight Line Double Declining

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

On The Tab Marked Depreciation Schedule Complete Chegg Com

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

How To Calculate Depreciation On Rental Property

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Macrs Depreciation Calculator Based On Irs Publication 946

/GettyImages-1086691530-82d69e3d619b47a3883b0c71164a3260.jpg)

Calculate Depreciation Methods And Interpretation

Business Costs That May Be Capitalized Eme 460 Geo Resources Evaluation And Investment Analysis

How To Calculate Uk Depreciation Depreciation Rates And Definitions

Depreciation And Book Value Calculations Youtube